Labour and it’s Civil Society allies have urged Federal Government to ensure all individuals and multinationals are made to pay appropriate tax so as to finance the budget deficit.

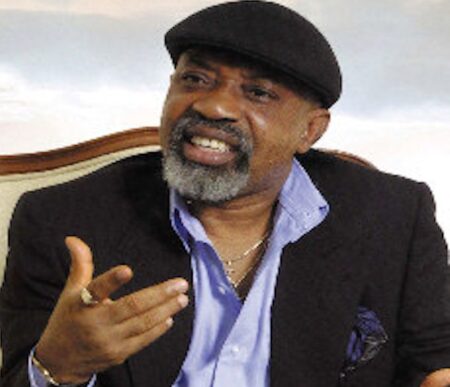

Speaking at a two days meeting organised by Public Service International on on increasing Trade Union and Civil Society participation in the fight against Illicit financial flows in Nigeria, Deputy President of NLC, Comrade Peters Adeyemi said it is unfair for government to continue to tax poor workers while the rich invade tax.

“what we are saying is that for government to raise money to finance the budget without necessarily putting burden on the working poor, particularly Public and Civil servants. We are saying government must ensure tax Justice, that is the rich must be properly tax against what we currently having in the country today”.

Speaking further, Comrade Adeyemi who is also the Vice president of Public Service International worldwide (PSI) said government has not business increasing the price of Petroleum products or excessively taxing workers to make up the deficit in the budget.

While commending the war against corruption by present administration, the labour said it is not yet uhuru until the Nigeria masses started feeling the impact on infrastructural development in the country.

Also in a resolution after the meeting, the group urge government to reduce tax incentives granted to multinational companies in Nigeria.

The resolutions which was read by Comrade James Eustace of the NLC also said the fight against illicit financial flows will achieve more results with the involvement of all stakeholders.

“We believe that the government of Nigeria can collect more revenue by reducing unnecessary tax incentives to multinational companies. This will help to address the challenges of funding public infrastructure development, provide and expand social protection benefits to Nigerians, especially the indigent ones, and assist in wages of public sector workers, as well as aid employment creation.

“We also believe that the government’s fight against illicit financial flows will be more successful with the involvement of all stakeholders, including Trade Unions and the wider civil society.

“Further, participants unanimously agreed that fair tax payment is a legal and moral obligation that all taxable individuals and entities must be happy and proud to fulfil, especially when such accrued revenues are judiciously and effectively used to improve the welfare and well-being of all. Worries were also expressed concerning the situation where the poor and those in the informal economy, especially women continue to be subjected to multiple taxation payments and extortions “.